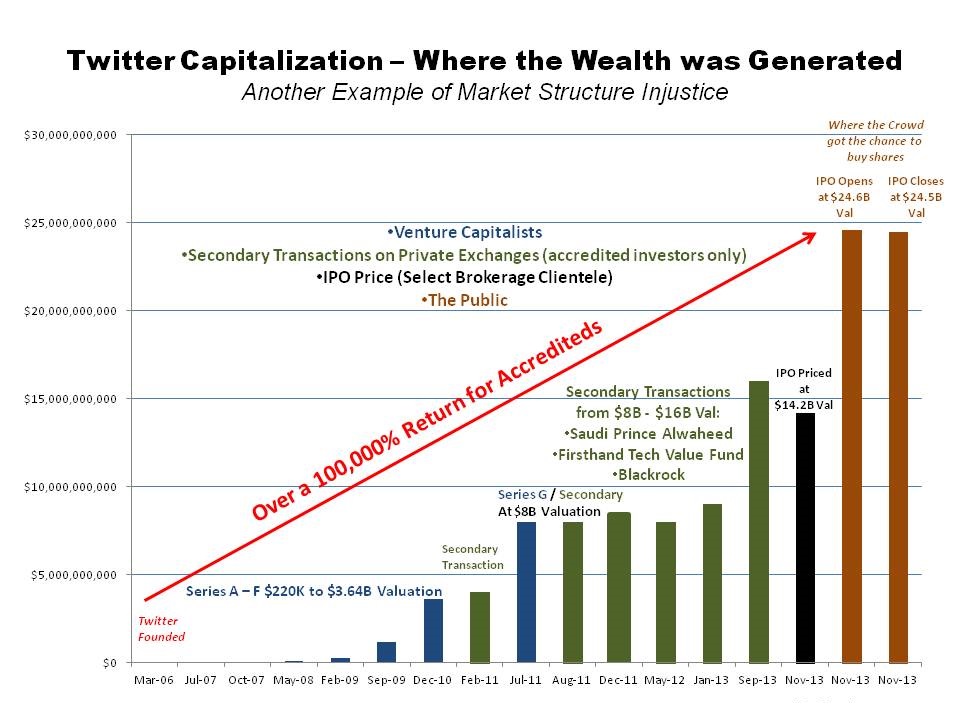

In a formulated stark contrast to Facebook’s IPO debacle, Twitter (NYSE: TWTR) made its public market debut yesterday with underpriced shares. Priced at $26 per share, Twitter opened at $45.10 and closed the day at $44.90 giving Goldman Sachs’ most cherished institutional clients an instant 73% return. Mind you that this is a far cry from the 207% that Saudi Prince Alwaheed realized and the whopping 100,000+% increase that the early venture capitalists yielded simply by possessing the liberty to purchase privately held shares.

While the minions, forbidden from investing in private companies, lined up to buy publicly-traded Twitter shares above $45, yet another hot technology company exemplifies how inequitable US market structure has become (see: https://daraalbrightmedia.com/2012/06/05/how-facebooks-ipo-exemplifies-the-injustice-in-the-financial-markets/).

Until unaccredited investors are granted the same investing freedoms as accredited ones, the public markets will remain an exit strategy for the financially privileged, and the wealth disparity of a once democratic nation will continue to widen.

Who knows? Perhaps today’s retail investors buying stock at $45 will also realize a 100,000+% return. And if they are lucky, it might even happen before humans have lost their pinky toes and begun populating distant planets.

Leave a Reply