With the exception of the occasional red-hot IPO, investments don’t sell themselves. If they did, there wouldn’t be much need for financial media, research analysts or investment advisors. Nor would there be any acting gigs for former Law & Order stars, who always seem to wind up back on the airways, peddling some sort of financial product like reverse mortgages, gold bullions or discounted brokerage services (cue Law & Order theme clang).

Security offerings, like any type of product vying for market share and devoted customers, require a solid marketing strategy in order to target suitable investors. Otherwise, raising capital is all but impossible. CEOs need to be as diligent about marketing their securities as they are about promoting their products, for even the most genius invention could fail without a steady stream of growth capital and a loyal shareholder base.

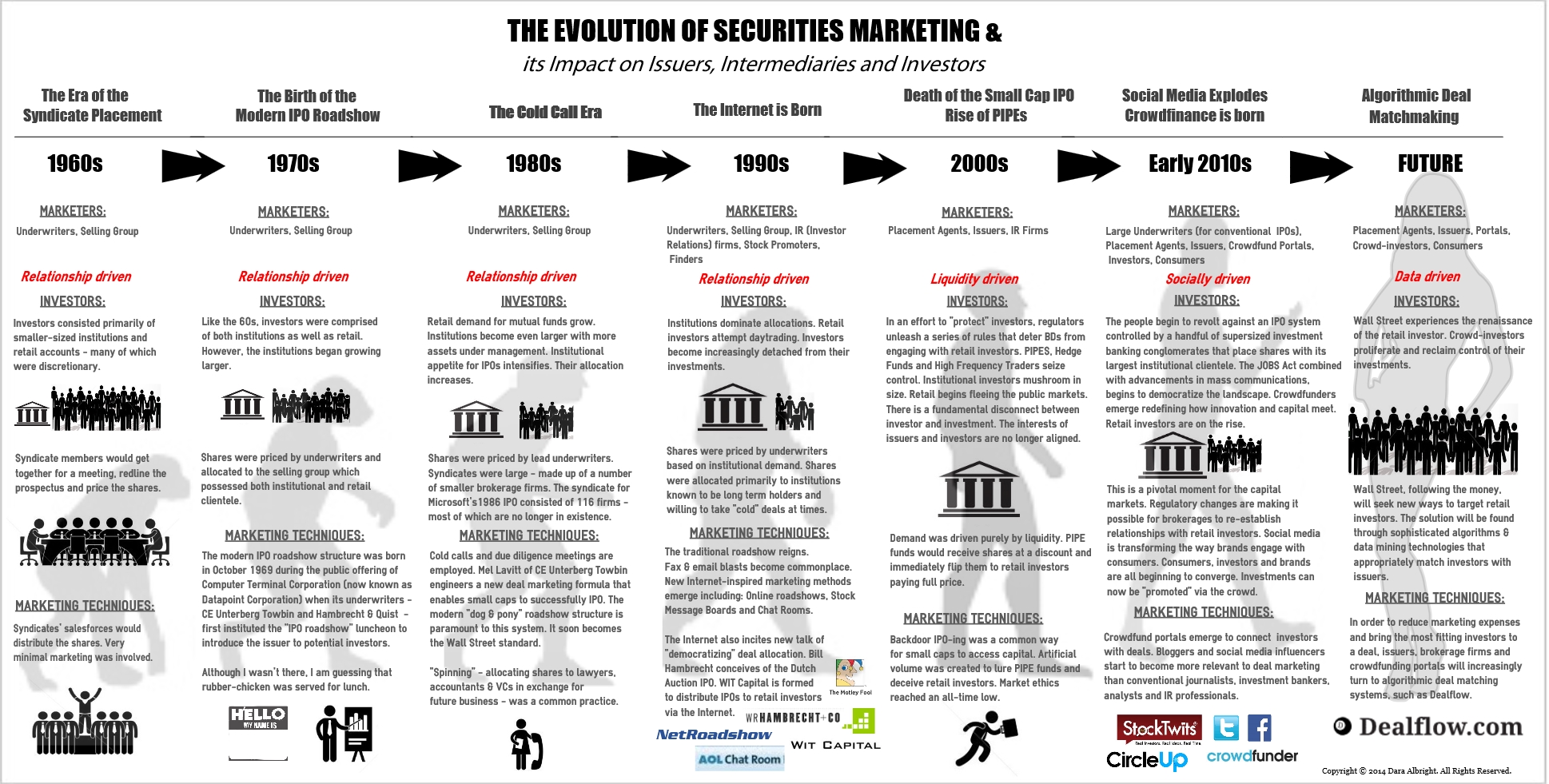

Most people don’t realize it, but throughout modern history, the marketing of securities has had a profound impact on global innovation and economic growth. It plays a crucial, yet understated, role in determining which inventions will reach the masses, the type of jobs that will be created, and how wealth gets distributed.

The manner in which securities are marketed to the investing community is constantly evolving, and it is influenced by the combined adaptations of technology, media as well as securities regulations. The confluence of these forces continue to transform the financial ecosystem by altering the dynamics among issuers, intermediaries and investors.

The infographic below underscores the fascinating maturation of how capital is raised and distributed. It reveals how technological advancements in mass communications have progressively enabled issuers and intermediaries to more efficiently connect with potential investors. It illustrates how, until recently, institutional investors ballooned at the expense of the retail investor – particularly due to the flurry of regulations, following the dotcom crash, which dissuaded Broker / Dealers from engaging with smaller investors. Most significantly, it draws attention to pivotal new market trends on the verge of, yet again, redefining the financial landscape.

This is truly an extraordinary moment in stock market history. The financial winds are rapidly shifting, and they are headed in the direction of the individual investor. Legislative action is being undertaken to ease compliance pressures so that Broker / Dealers could reunite with the retail investor. Information technology has made it possible for the investing public to reclaim control of how their assets are allocated. And more wealth continues to be transferred to a new generation of investors who are disdainful of grandiose financial institutions, yet eager to “crowdfund”.

However, as the infographic depicts, targeting retail investors – especially crowd-investors – requires a completely different “marketing toolbox” than was needed for pursuing institutional investors. This new paradigm will involve sophisticated algorithms and data mining technologies, also known as, “Algorithmic Deal Matchmaking”.

Issuers, intermediaries and investors at the forefront of these new techniques stand to benefit substantially as the economic pendulum swings. Learn more on October 21st in New York City where key architects of the JOBS Act, Congressman Patrick McHenry and David Weild IV, as well as recognized crowdfinance legal and marketing experts will deliberate these trends and present new executable deal marketing solutions. Complete details can be found by clicking here.

Leave a Reply