Based on LinkedIn’s public debut today, my Bubbleometer detected the slightest silhouette of a bubble brewing – an inevitable consequence of public market trading. The stock which was issued at $45 reached $122.70 before closing at $94.25 on trading volume of 30.2 million shares.

LinkedIn represents the first social media company to have come of age in the secondary markets and graduate to IPO stardom. Today’s activity demonstrates the voracious demand for social media companies and the lack of supply in the public markets. This should bode well for the private company marketplace as accredited investors clamor to accumulate other pre-IPO social media stocks that can soon be fed to insatiable retail investors.

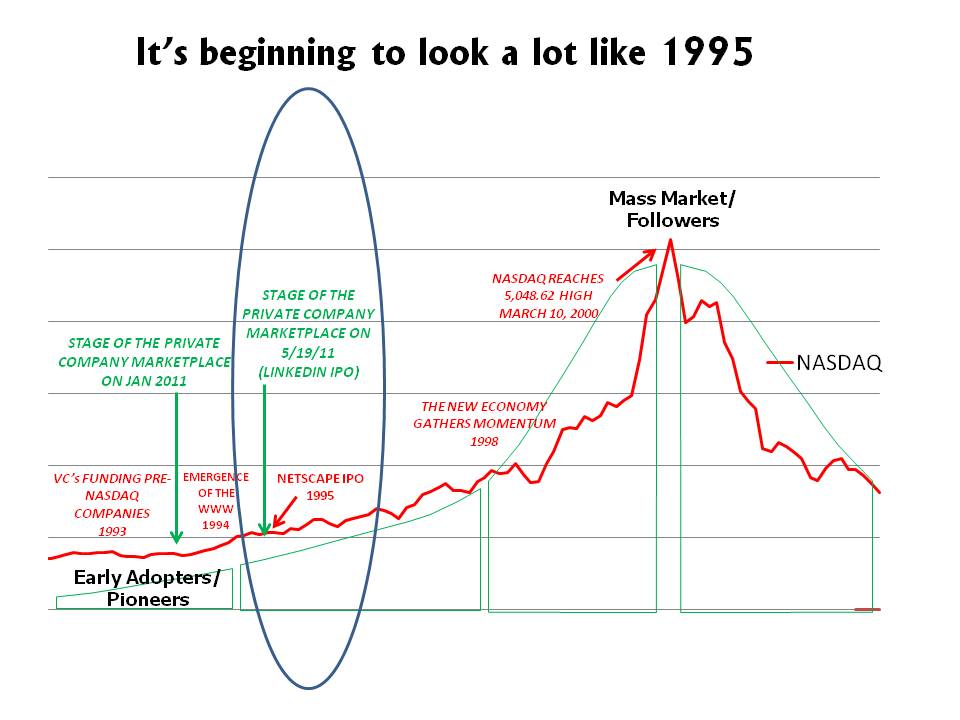

It’s beginning to look a lot like Christmas or at least 1995 when Netscape made its appearance onto the public stage. Much like dot com propelled NASDAQ nearly two decades ago; I believe the current social and mobile revolution will drive today’s private company marketplace. We have only just begun.

Leave a Reply