Developed in 1952 by Harry Markowitz, the Modern Portfolio Theory (MPT) is premised on the notion that portfolio returns can be maximized by spreading risk across many different investments. With an estimated $7 trillion in institutional assets currently invested in accordance with the methodologies of MPT, it continues to be one of the most important and effective strategies of modern investing for both institutional and retail investors alike.

Developed in 1952 by Harry Markowitz, the Modern Portfolio Theory (MPT) is premised on the notion that portfolio returns can be maximized by spreading risk across many different investments. With an estimated $7 trillion in institutional assets currently invested in accordance with the methodologies of MPT, it continues to be one of the most important and effective strategies of modern investing for both institutional and retail investors alike.

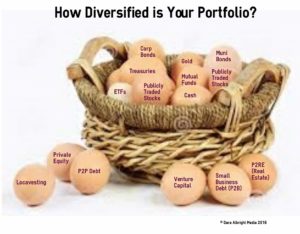

Any financial planner will attest that diversification has become a fundamental component of nearly every retirement portfolio. Some would even argue that having a properly diversified retirement portfolio is about as crucial as possessing retirement savings at all.

Unfortunately, due to capital, technological and legislative restraints, smaller retail investors have not been able to benefit from the same diversification opportunities as deeper-pocketed investors. In fact, until relatively recently, the only way smaller retail investors were able to diversify at all was through mutual fund investing. But, particularly with bond fund performance languishing, it has become harder and harder for retail investors to justify the management fees.

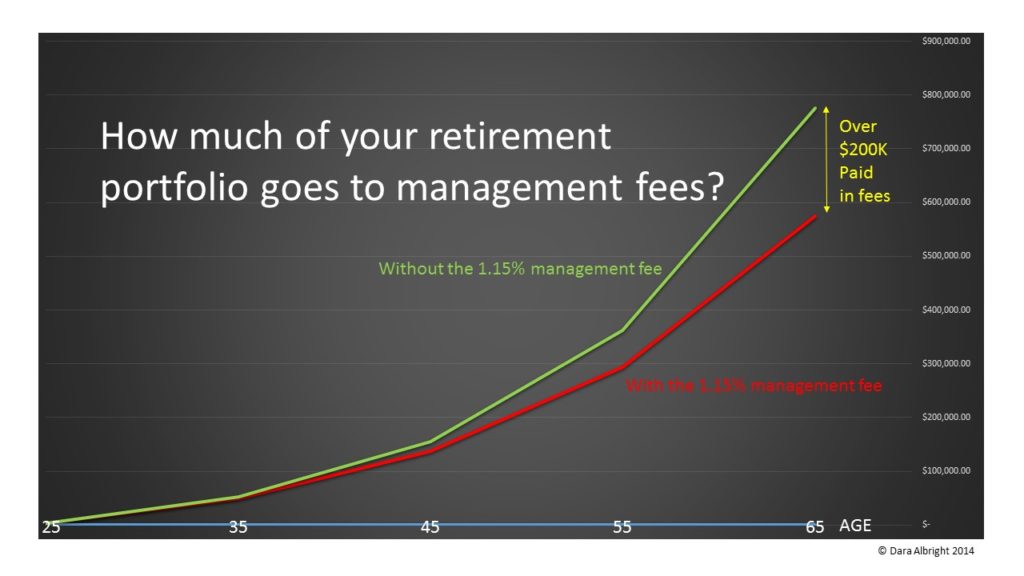

Although they can’t count on fund performance, retail investors can pretty much bank on rising management fees. According to Forbes, over the 2001 to 2012 period, mutual funds have raised their fees from an average of 0.62 % of assets to 1.15% of assets – an 84% increase – even as many failed to outperform. While 1.15% may seem insignificant, it can amount to hundreds of thousands of dollars in fees over the course of one’s working life.

Below is a chart that quantifies the dollar value of 1.15% in management fees over the course of one’s career. This chart supposes that a 25 year old invests $300 per month in a fund that returns 7% per year until he is 65 years old. Over the course of the 40 year period, more than $200,000 – or 25% of his portfolio value – will have gone towards management fees.

Fees aren’t the only drawback to mutual fund investing. They tend to be too highly correlated to most other conventional asset classes. Furthermore, according to Steve Wallman, founder of Folio Investments, an established leader in the FinTech industry, “mutual funds don’t allow for any personalization – they are all a one-size-fits-all solution to diversification. Also, they have tax disadvantages as compared to owning individual securities.”

Realizing the limitations of mutual fund investing and foreseeing the demand for greater investment personalization, Wallman founded Folio 15 years ago. Folio allows investors to create baskets or “folios” of up to 100 securities including fractional shares of stocks, ETFs, mutual funds and ultimately a growing number of alternative asset classes such as crowd-financed offerings. In doing so, Folio combines the benefits of diversification with the advantages of customization and investing control – all at a price point suitable for today’s micro-investor.

Blaine Mclaughlin, COO of VIA Folio, Folio’s private investing business line, stated, “Most would agree that one hundred different $20 investments are less risky than one $2,000 investment. However, in order to facilitate these investments across a number of different asset classes, the baseline cost of investing needed to first be driven down by technology and self-service. It is this great technological achievement that has paved the way for micro and fractional investing to become an economic reality.”

With technology making micro and fractional alternative investing affordable, simpler and more accessible, smaller investors are finally starting to benefit from the same diversification strategies that have been enjoyed by institutions for decades.

This trend towards tinier investment thresholds will have epic implications on the hierarchy of financial services (see: https://daraalbrightmedia.com/2016/02/25/did-a-tech-bubble-just-burst-in-the-midst-of-a-fintech-revolution/). As robo-advisors and micro-investing apps lure retail capital back into the markets with renewed optimism, established financial institutions will encounter increased disruption from FinTech startups.

I, for one, am elated by the ingenuity emerging in the micro-investing space.

I was recently introduced to an exciting new digital investment advisor called Stash which facilitates micro-investments based on one’s interests, beliefs and goals. Starting with as little as $5 – less than the price of a Starbucks Venti Skinny Vanilla Latte in New York City – Stash offers micro-investors the ability to diversify across investment products more aligned with their personal ideologies. Whether you are passionate about defending America, supporting her greatest innovators or ensuring diversity, Stash can help tailor diversified portfolios based on those objectives.

Catering to today’s peer oriented investor, Worthy, is an up-and-coming game-changing app that lets micro-investors invest in their peers – with a little help from their favorite retailers. In doing so, Worthy not only helps micro-investors diversify with less-correlated alternatives, it also offers consumers an unprecedented ability to spend their way to retirement. Now, who wouldn’t want to do that? This isn’t the first time that I’ve written about Worthy – nor will it be the last. I believe the company is laying the groundwork for a reconstitution of America’s retirement planning industry.

The employment of micro-investing technologies and the proliferation of digital investment apps is the first step towards democratizing and modernizing the MPT. However, in order for diversification to remain a viable and equitable strategy, modern retirement plans must be able to accommodate micro-investments – particularly micro-alternative investments.

As Todd Yancey, CSO of IRA Services explains, “Most retail investors don’t invest with the cash they have lying in their checking and savings accounts. Instead, they typically invest with their retirement dollars. As such, micro-investing technologies will achieve maximum impact when employed at the tax-deferred level. That is why IRA Services has devoted more than three years and over $10 million in developing the ISCP technology. Our goal is to ensure that even the smallest of retail investors are able to easily and affordably spread their retirement dollars across a wide-range of asset classes.”

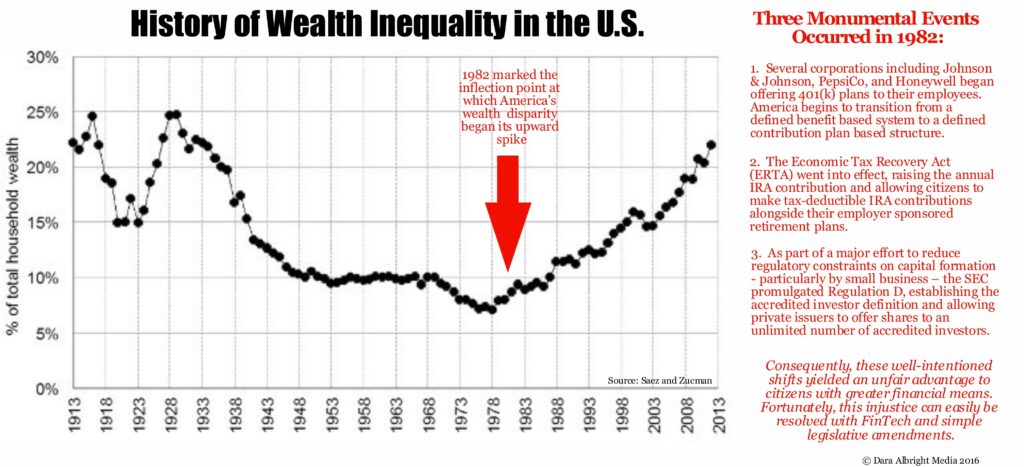

As was stated in our recently released white paper and as the chart below highlights, “Unless and until all citizens are granted the same chances to build a well-diversified retirement portfolio, America’s wealth disparity will continue to mushroom.”

FinTech which facilitates tax-deferred micro-alternative investing is more than just cutting-edge technology. It very well may be the catalyst that reverses America’s harrowing wealth gap.

49% of the worlds wealth is held in real estate and yet only 12.9% of the worlds population has access to it. We are changing that with technology and the mission is to empower a billion people by 2020 – https://youtu.be/1UeY6DYq92c

Great stuff! Thanks for sharing Scott. Let’s schedule some time to speak in the upcoming weeks. I’d love to learn more about about your platform.

Agree with Scott that most of the not yet engaged investors in assets without the burden of fees the article mentions are at first interested in real estate. To the point where we’ve created SyndicatePath to allow for smaller investors to own commercial real estate in their communities while giving brokers more than twice the commission in half the time typical in selling an income property.

The people regard real estate as safer because they understand it. Once other investment classes are seen to be safer, say those assured by methods like ours, which repay the investors in a failure, you’ll see the broadest sectors of investors seeking and buying the alternatives to the burdensome fees described.