On October 21, 2014 – Two and a half years after the signing of the JOBS Act – a group of crowdfinance luminaries and Wall Street veterans assembled in New York City to outline a more practical framework for “unaccredited crowdfunding” – one that would essentially restore the once thriving small cap IPO ecosystem that fueled decades of economic prosperity.

Because of their diminutive offering and investment sizes, many industry professionals misconstrue “unaccredited crowdfunding” as inconsequential – much like NASDAQ offerings were initially perceived by the establishment decades ago. But last month’s gathering marked a significant turning point for the crowdfunding movement. For the first time since the passage of the JOBS Act, unaccredited crowdfunding was portrayed in its true form: the rebirth of the retail-driven small cap IPO.

As the event producer, it was quite an honor for me to have been joined not only by those industry trailblazers shaping tomorrow’s capital markets, but by legendary underwriters who had brought Intel, Apple and many other iconic brands to the investing public, and in doing so, transformed NASDAQ into the crown jewel of American capitalism. Although new technologies and securities legislation changed the way the game is played, the mission remains the same: to bridge the people’s capital with the innovation of the day.

The issue is not whether unaccredited crowdfunding a.k.a. retail investing will foster economic growth and decrease a harrowing wealth gap. History has proven that it will. Rather, the question is what is the most pragmatic regulatory solution in today’s technologically advancing world? Many industry leaders – including Congressman Patrick McHenry who introduced the initial securities-crowdfund legislation in Congress in 2011 – are starting to realize that answer lies not in Title III, as many had hoped, but rather in Title IV, the component of the JOBS Act that amends Regulation A.

The “Reg A Crowdfinanced Offering” (RACO) was introduced at the event. The consensus was that Blue Sky preempted Reg A offerings in conjunction with sophisticated deal matchmaking technologies and vibrant secondary exchanges could indeed become the engine that powers the next small cap IPO boom.

Hailed by many as the most significant program yet on crowdfinance, JOBS Act exemptions, capital formation and small cap liquidity, the event featured illuminating speeches and presentations by key architects of the JOBS Act – Congressman McHenry and Dave Weild, former Vice Chairman of NASDAQ and Chairman of IssuWorks – as well as instructive discussions by leading legal and deal marketing experts. Key takeaways gleaned from the sessions include:

- Title III is officially stalled (however, now that the midterm elections are over and the political winds have shifted, the SEC may have more of an impetus to move);

- Reg A will have a viable exemption for Blue Sky (whether it is implemented as proposed or legislatively mandated in the future);

- Higher offering thresholds for unaccredited crowdfunding will be introduced;

- Future bills will focus on improving secondary markets;

- We’re likely to see a decline in 506(c) offerings if Reg A+ is implemented as proposed;

- Broker Dealers are seeking ways to engage in public deal marketing via a platform;

- Online crowdfunding is far from being completely automated;

- Small caps will always require active marketing;

- Data is essential to finding investors;

- Although the amount of invested capital has not risen, the number of investors reported in Reg D offerings increased 50% over historical averages – an indication that accredited retail investing is on the rise;

- A reallocation to small cap stocks is paramount to economic growth;

- Just like quarter spreads are wrong for large caps, penny ticks are wrong for small caps;

- At least 10 cent spreads are needed to make it economically feasible for BDs to get behind smaller less liquid stocks;

- We’re in the third inning of a 9 inning game.

DETAILED SYNOPSIS OF THE SMALL CAP IPO REVIVAL EVENT

Congressman McHenry’s Keynote

Congressman Patrick McHenry kicked off the evening by stating that the JOBS Act is not only the most significant rewrite of security laws, it is the one key piece of legislation in the past 3 ½ years to emerge from a divided Washington.

The legislator most identified with unaccredited crowdfunding has shifted his attention to Reg A – stating that instead of a “dead letter”, Reg A can be a lively opportunity for capital formation. Most importantly, McHenry asserted that Reg A must have a viable exemption for Blue Sky, as was proposed by the SEC in December 2013.

He also introduced his stair-step approach to capital formation that enables companies to graduate to the public markets. This would include utilizing equity crowdfunding for raises up to $10 million, and Reg A+ for offerings up to $50 million. The Congressman also acknowledged that more work needs to be done to make the public equity markets enticing enough for small caps.

As he set the stage for JOBS Act 2.0, Wall Street should anticipate higher offering thresholds under Title III, a legislative mandate for Blue Sky exemption if necessary, and new directives to re-incentivize market makers such as Weild’s tick-size initiative.

McHenry reminded the audience that there are approximately 360 bipartisan house bills that Harry Reid never brought to the Senate floor. Now that the midterm elections are over and the political winds have shifted, we can expect more bills related to small business capital formation to come up for vote in the Senate.

McHenry’s speech can be viewed in its entirety at: https://www.youtube.com/watch?v=XZ-czQkc0S8&list=UUrV1NUHcbuHnlJkcQU7RWgA

All-Star Legal Panel

The All-Star legal panel, moderated by Brian Korn, Co-head of Crowdfunding and P2P at Pepper Hamilton, began with a comprehensive overview of Reg A+ and a detailed comparative analysis of the current crowdfinance landscape. The full legal panel which also includes discussions on legislatively fixing 12g thresholds, logistical issues pertaining to depositing small cap stocks and proposed changes to the accredited investor rule can be viewed at: https://www.youtube.com/watch?v=DRzSstiG6zQ&index=1&list=UUrV1NUHcbuHnlJkcQU7RWgA

Innovations in Small Cap Marketing

The marketing panel provided great perspective into how innovations in technology, media and securities regulations are transforming corporate finance and reinventing the way in which deals are served to the investing public. They illustrated modern marketing tactics to reach a new breed of retail investor known as the “crowd-investor” (see also: http://daraalbright.com/2014/10/09/the-evolution-of-securities-marketing-and-its-impact-on-issuers-intermediaries-and-investors/).

Steven Dresner, CEO of Dealflow, described how much of the same data mining ingenuity that enables brands target consumers is now being deployed to pinpoint investors and close more deals.

Chris Tyrell, CEO of OfferBoard, is using technology to recreate traditional sell-side syndicates and has already begun partnering with conventional Broker Dealers. According to Chris, Broker Dealers are eager to engage in public deal marketing via a platform; however, they lack the infrastructure. As such, more and more are starting to see the value in partnering with companies like OfferBoard.

Drawing from the rewards-based crowdfunding playbook, where campaigns with videos raise 114% more capital than those without[i], Gene Massey, CEO of MediaShares, discussed how video marketing will begin playing also a significant role in attracting investors.

Both Dealflow and OfferBoard also track private offering data. Each firm recently released white papers containing significant findings on 506(c) PPOs (“Private Public Offerings”), a term coined by veteran venture attorney, Joseph W. Bartlett. Of particular interest was that according to OfferBoard’s study, the number of investors reported in Reg D offerings increased 50% over historical averages, yet the percentage of offerings with non-accredited investors has decreased to just under 7% in the past 12 months. OfferBoard attributes this decline to the prohibition on non-accredited investors in 506(c) offerings. I believe these combined factors illustrate a renewed enthusiasm from retail investors overall, which should bode well for new Reg A+ where all investors, regardless of net worth and income levels, will have an opportunity to participate.

The complete marketing panel can be found at https://www.youtube.com/watch?v=y-WBEiYQ1GQ. The white papers can be found at http://www.offerboard.com/whitepaper.asp as well as http://dealflow.com/whitepapers/Dealflow_White_Paper_Q3_2014.pdf.

Dave Weild’s Powerful Close

Dave Weild, whose work prompted the JOBS Act and inspired the industry of crowdfinance, wrapped up the discussions with an impactful close that earned him a standing ovation.

He began by stating that “Government policy is the single most important factor in having robust capital formation – noting that unsound policy is what depressed the economy and cost America 10 million jobs.”

Dave explained that if regulators hadn’t mucked with market structure in the first place, the U.S. would be looking at 13,000 listed companies today as opposed to 5,000 – a discrepancy which accounts for the current job crisis.

Dave goes on to say that fortunately, “the JOBS Act is the most important pro-capital formation legislation in a generation.”

Identifying “the small cap IPO as the bedrock of our future”, Dave expounded that there are two ways to fix the small cap liquidity problem:

- Repair broken market structure by incentivizing market makers

- Employ technology to reach smaller investors who don’t have liquidity constraints

He also discussed the genesis of Reg A+, how penny ticks are as wrong for small caps as quarter spreads are for large caps, and how his tick size rule (see: http://www.sec.gov/rules/other/2014/34-72460.pdf) can trigger a desperately needed reallocation to small caps.

My favorite part of Dave’s presentation was when he placed government overreach in a historical perspective, remarking that our ancestors rode in covered wagons, battled Indians and were dying of disease, yet here we sit fretting over limited disclosure.

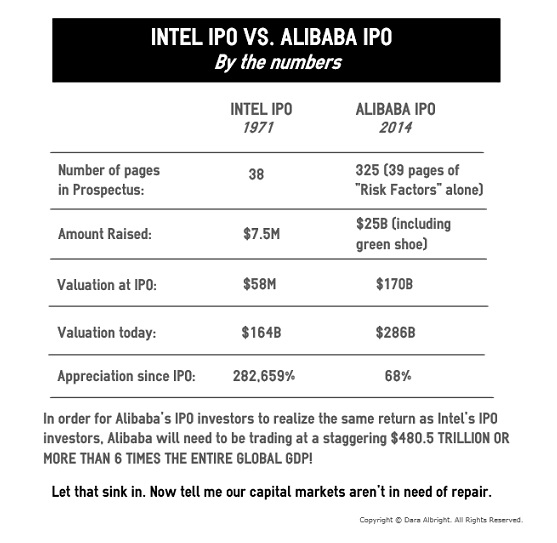

It was then that Andy Malik, Chairman of Needham & Co., having participated in both the Intel as well as the Alibaba IPO chimed in. In 1971, Intel, a 3 and a half year old company, went public at a $58M valuation with profits before extraordinary items of only $93,000. After missing its first product delivery, Intel’s stocked dropped over 60% in value before going on to become one of only 11 companies in the world that at one time would have a market capitalization in excess of $500B. Andy compared the Intel prospectus of a mere 38 pages to Alibaba’s 300+ page prospectus. The exchange between Dave and Andy inspired me to create the following eye-popping comparison chart.

Intel – that embryonic micro-cap company that couldn’t even deliver its first product on time – inspired not only a generation of iconic brands, it birthed entire industries including semiconductors, computers, wireless and genomics.

To paraphrase Dave, “Since no one is smart enough to predict the ripple effects of game-changing technologies, it’s important that we have a capital markets system that provides opportunity for a wide range of businesses. Only by having lots of balls in the air will we increase our odds of capitalizing that one company that may very well save mankind.”

Finally, what resonated most with me was when Dave reminded us of the real reason we had all congregated on that October evening. It wasn’t about tick sizes, politics or even finances. “It was all about the legacy we are leaving our children.”

Dave’s entire presentation including Q&A can be found at https://www.youtube.com/watch?v=lOFcMHpDgUY

[i] Wall Street Journal

I pay a visit each day some web sites and sites to read articles, however this web site presents quality based content.

Thanks Melba!

“unaccredited crowdfunding” will more efficiently mitigate business risk through more efficient capital allocation, a lot like insurance risk spread amidst the masses. The result is a more stable financial system less prone to economic bubbles…for our children.