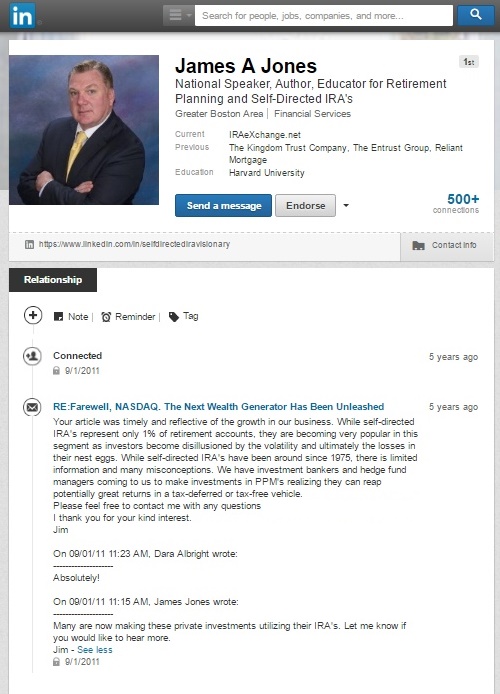

A little over five years ago, a self-directed IRA expert named Jim Jones reached out to me through LinkedIn to discuss the value proposition of the self-directed IRA – a retirement vehicle that gives individual investors greater control of their retirement capital and the freedom to invest beyond conventional asset classes and into coveted alternative investment products.

Jim’s communication was prompted by an article I had recently published which drew remarkable parallels between NASDAQ’s great rise and a new generation of venture platforms that were essentially “making markets” in young, private companies including Facebook and Twitter. Jim described how a growing number of high net worth investors had begun turning to self-directed IRAs so that they could use their retirement dollars to invest in many of these hot, pre-IPO companies. As time revealed, many of these sophisticated investors were able to generate significant returns in tax-advantaged accounts. In fact, it is well documented that PayPal Founder and venture capitalist, Peter Thiel, amassed an impressive fortune using a self-directed IRA to custody his PayPal and Facebook holdings. See: http://www.forbes.com/sites/deborahljacobs/2012/03/20/how-facebook-billionaires-dodge-mega-millions-in-taxes/#ceeef5565f60

To say that I was intrigued by Jim’s message would be an understatement. I was eager to learn everything I could about self-directed IRAs – a product that, although had been in existence for decades, was only just beginning to garner popularity due to a mounting demand for alternative investment products. I was particularly interested in trying to figure out how this lesser-known retirement vehicle would impact financial services – an industry that I felt was on the eve of great transformation.

When Jim and I began dialoguing in mid-2011, I had just started producing a series of conferences that drew attention to a brewing Wall Street reformation which seemed to be emanating from emerging online finance platforms and new legislative proposals that were being tossed around the House Financial Services Committee.

I invited Jim to join my growing speaker roster of financial trailblazers in order to highlight the integral role that self-directed IRAs could play in this new financial paradigm. Jim’s presentations underscored how self-directed IRAs held the potential to finance a new wave of innovation while helping ensure that more Americans were better prepared for retirement.

With America’s most sought-after growth companies remaining private longer and with private debt far out-yielding conventional fixed-income asset classes, the “smart money” was increasingly being diverted to alternative investment products. Particularly in today’s financial climate – with interest rates kept at historic lows and public equity markets being artificially propped up by policy as opposed to profits – diversifying retirement portfolios with non-exchange traded alternatives is turning out to be more than just a prudent investment decision. It is becoming an absolute necessity – and one that can only be accomplished through the use of a self-directed IRA.

However, despite both the need and escalating demand for alternative investment products, the self-directed IRA industry still represents a paltry 1% of the $14 trillion dollar combined IRA and 401k market. Even as increased exposure to alternative investment products has been shown to enhance returns and mitigate portfolio risk, the vast majority of retirement assets remain disturbingly under-diversified in traditional IRAs and in employer-sponsored defined-contribution plans.

Why the incongruity?

According to Jim, who has dedicated the last 5 years of his career championing a systemic overhaul of the self-directed IRA industry, there are regulatory as well as technological obstacles that preclude retail investors from diversifying their retirement portfolios with alternative products.

Unlike conventional IRAs that are obtained primarily through one’s brokerage firm, self-directed IRAs are primarily accessed through independent IRS-approved custodians that possess distinct expertise in holding, administering and reporting on alternative assets. Self-directed IRA custodians commonly include banks, federally insured credit unions, or a savings and loan association. While these firms are proficient in providing the safe-keeping and valuation reporting of alternative assets, unlike brokerage firms, they are precluded from providing investment advice and in sharing or collecting investment product commissions.

IRS-approved trust-based custodians have also been limited by their archaic technological infrastructure that – until just recently – has had to rely on decades-old technology in order to facilitate self-directed IRA investing. In contrast to brokerage IRAs that handle a large volume of smaller-sized actively-traded assets, self-directed IRAs have customarily held a few sizeable positions in less volatile assets such as real estate or small private businesses. As such, until the recent rise of P2P/crowd-investing, there was little pressure on self-directed IRA custodians to automate or expedite transactions.

Brokerage firm IRAs face even greater challenges in trying to accommodate this new style of retail investing. However, instead of technological constraints, the brokerage IRA is severely hampered by compliance restraints. These regulatory limitations impede brokerage firms from both soliciting alternative products as well as from providing retail investors with a viable and affordable self-directed IRA product.

The growing influence of crowdfinance is beginning to cause all IRA custodians to rethink their target demographics.

The target self-directed IRA investor is no longer just your standard house flipper, coin collector or high-net worth venture investor. Nor is the target brokerage IRA investor your typical mutual fund holder.

The modern retirement investor has a new mission. She is determined to distribute small amounts of her retirement capital across the growing number of alternative products becoming readily available through online finance platforms and micro-investing apps. She may be a millennial looking to start a retirement plan or an existing IRA or 401k holder – disenchanted with mutual fund options – looking to reallocate a portion of her current portfolio to alternatives.

In order to accomplish her goals, this modern self-directed micro-investor requires a low-cost, high speed, autonomous retirement investing solution that neither the 40-year old legacy self-directed systems nor the FINRA-restrained broker dealers are capable of providing.

Most significantly, she is representative of a $14 trillion plus market opportunity that is being stifled by outdated technology and regulations.

Therein lies both the conundrum as well as the trillion dollar FinTech opportunity.

Fortunately, a sustainable self-directed IRA solution is emerging. Not only will it completely transform retirement planning, it will uproot the entire financial services industry. It will alter asset allocation models. It will divert retail attention from mutual funds and EFTs into alternative asset classes that offer more customizable diversification solutions. It will inspire a new breed of non-exchange traded alternative investment products. It will create a host of new financial services jobs. Most importantly, it will re-democratize the flow of capital and help narrow the national wealth gap.

This is the first in a series of new articles by Dara Albright that will focus on next-generation retirement planning. The subsequent piece will detail the impediments of a brokerage IRA and highlight the significant advantages of the modern hi-tech self-directed IRA.

You are welcome to join us either in person on November 15th in NYC or online at FinTechREVOLUTION.tv as industry luminaries underscore how this trillion dollar FinTech opportunity will impact all members of the investing ecosystem.

Details on FinTechREVOLUTION.tv can be found by clicking here.

Those wishing to join us in person in New York City on November 15th are welcome to register by clicking FinTechRevolutionNYC. You can obtain the special complimentary access code by joining our guest list or by emailing guestlist@daraalbright.com. Although there is no registration fee, admittance is available only to those who are either on the guest list or who have received personal invitations. Please note that ticket availability is on a first-come first-serve basis.

Leave a Reply