I would like to thank everyone who joined us at the FinTech Revolution event in New York City and over the digital airwaves on November 15th.

I am especially grateful for our speakers whose products, technologies and visions are dramatically improving and democratizing financial services. Some of the event highlights – which are all available for viewing on demand at FinTechREVOLUTION.tv – included:

- Ron Suber, President of Prosper Marketplace, described how as traditional debt markets were collapsing, marketplace lending continued to perform; thus, underscoring the magnitude of asset class diversification.

- Mark Rockefeller, CEO of StreetShares, discussed harnessing social loyalty while creating better yield for retail investors. “Doing well by doing good” is the hallmark of modern finance.

- Brian Korn, Head of Digital Finance and Marketplace Lending in the Capital Markets practice group at Manatt, Phelps & Phillips, LLP, illustrated how Reg A+ is being employed to expand alternative product distribution. The utilization extends well beyond online platforms and marketplaces. In fact, anyone involved in the sale of alternative securities needs to become knowledgeable about the modern regulatory framework.

- Gene Massey, founder of MediaShares, helped us envision new types of profit participation models made possible by Reg CF. In this new structure, customers as well as employees will have greater opportunities to partake in corporate profits. He demonstrated how especially entertainment businesses – by providing economic upside to fans, cast and crew – can be prime beneficiaries of this novel financing construct.

- James A. Jones, self-directed IRA expert, stressed the importance of tax-deferred investing and highlighted the emergence of new retail distribution channels including Worthy, a cutting-edge digital app that helps millennials through retirees spend their way to greater retirement income.

- Todd Yancey, Chief Strategy Officer of Investor Services, unveiled the next-generation retirement product – a modernized self-directed IRA that is much better suited for contemporary retail investors who are increasingly looking to mitigate risk and capture greater yield through micro-investing diversification.

As we emphasized the unfurling of a new generation of alternative investment and retirement products, I can’t help but feel like we are re-living 1981 all over again – well, except without the double-digit interest rates or having to wait on a five hour line to buy a Rubik’s Cube.

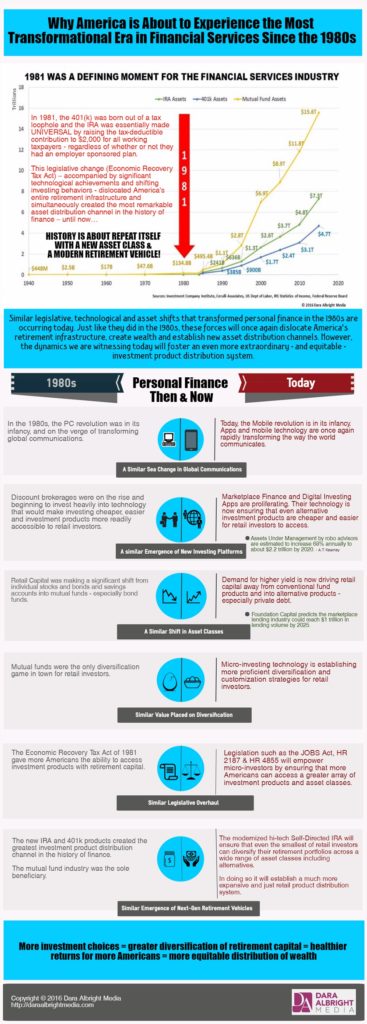

There are remarkable parallels between what is transpiring today in America’s legislature, financial markets and technology labs to a series of disruptive events that were set off in 1981 with the signing of the Economic Recovery Tax Act.

That legislation – along with significant strides in financial technology and investment product ingenuity – dislocated America’s entire retirement infrastructure and simultaneously created the most remarkable asset distribution channel in the history of finance.

Until now.

As depicted in the infographic below, similar technological, legislative and asset shifts that transformed personal finance in the 1980s are occurring today.

Just like they did in the 1980s, these forces – commonly referred to as “FinTech”, “RegTech” and “AltTech” – will once again revolutionize America’s retirement infrastructure, create substantial middle class wealth and establish new asset distribution channels. However, the dynamics we are witnessing today have the potential to cultivate an even more powerful – and equitable – investment product distribution system.

The impact on the entire financial services industry – not to mention the economy at large – will be colossal.

Like many other industries that have been displaced by technology, within great disruption lurks enormous opportunity which can be seized upon by all members of the financial ecosystem – fund managers, financial advisors, investment bankers, businesses and even the American public.

Learn how to capitalize in this modern financial paradigm by participating in upcoming FinTech Revolution events in cities across the country or by tuning into FinTechREVOLUTION.tv, a new online financial channel and producer of interactive and edgy content that makes personal finance interesting, entertaining and easy to comprehend. FinTechREVOLUTION.tv might just become the hippest thing to happen in broadcasting since the video killed the radio star.

Although there is no fee to attend FinTech Revolution cocktail events, admittance is by personal invitation only and available on a first-come first-serve basis. To receive invitations to upcoming events, simply add your name to our guest list at http://www.daraalbright.com/events/.

So, what are you waiting for? Turn off your Walkman, step away from the fax machine and join the revolution!

Click image twice for full-sized view

Thanks again Dara for the opportunity.

Dara, thank you for the great recap of the event. It is amazing to see how many disruptive technologies are being applied to the financial services industry – and how so many of those are helping everyone from professional investors to individual investors and savers.

What was once a fairly large and lethargic industry is becoming much more nimble and entrepreneurial. Great to see! And thank you for making the sessions available for those of us who could not be at the live event.