I once read that, in life, we encounter two kinds of people: 1) those who are blessings and 2) those who are lessons. And, in the end, we will thank them both.

I believe that a similar philosophy can be applied to our relationship with time. Throughout our lives, we experience two kinds of years: 1) the simpler ones that give us a chance to kick back, relax and enjoy and 2) the more challenging ones wrought by lessons. And, in the end, we will hold equal gratitude for both.

While my 2017 held some very enjoyable moments – and even some nuggets of sheer hilarity – they felt overshadowed by unremitting lessons.

Although a taxing year, I am thankful for the lessons learned in 2017. They made me all the more wiser, – not to mention, a hell of a lot stronger – and I’ve never felt more prepared to begin a new trip around the sun.

Instead of my customary year-end recap / predictions piece, I thought I’d take a slightly different approach and share the top ten kernels of wisdom that I’ve extracted from 2017, sprinkled with a few very bold predictions.

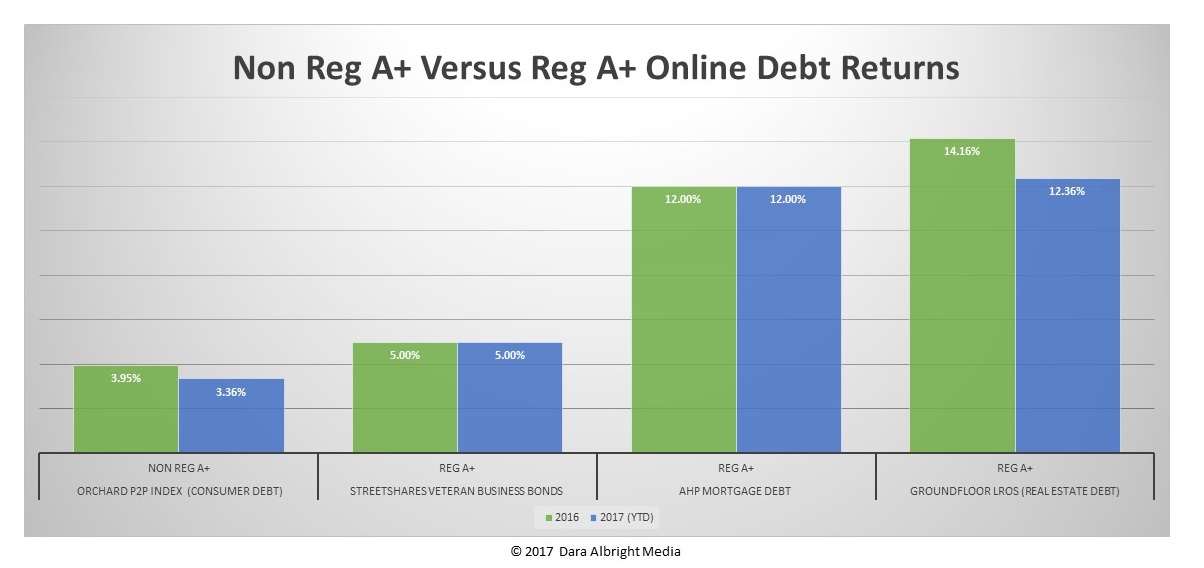

NUMBER 10: REG A+ YIELDS DOMINATE THE P2P LENDING LANDSCAPE

Since early 2015, I’ve been predicting that the Reg A+ exemption (Title IV if the JOBS Act) will inspire a new breed of higher yielding alternative fixed income products for retail investors. (See: Reg A+ will Transform the Alternative Asset Landscape and The Renaissance of the Retail Investor)

Although this product universe is still in its very nascent stages, as was forecasted and as is now evidenced in the chart below, the debt products emerging out Reg A+ are indeed offering the more competitive returns in the P2P debt universe. As more and more offline originators move online, as RegTech progresses and as self-directed IRA technology improves, you should expect Reg A+ debt products to play a much more significant role in personal finance.

NUMBER 9: CREATING VIABLE SECONDARY MARKETS FOR ALTERNATIVE DEBT AND EQUITY IS EASIER SAID THAN DONE

Whether we’re talking about venture markets to trade pre-IPO equity offerings or secondary markets to exchange P2P notes, the crowdfinance industry is constantly seeking viable liquidity solutions for its alternative investment products. Although there have been a number of FinTech startups that have attempted to launch such exchanges, so far none have had success in reaching critical mass. This is going to take a lot of patience. Rome wasn’t built in a day. Nor was NASDAQ (the premiere FinTech pioneer) for that matter. In fact, it took decades for NASDAQ to go from the “moribund backwater of the security industry” to the most powerful stock exchange in the history of the world. As we await the rise of formidable leaders, there are a few interim solutions.

First, with respect to equity offerings, there’s a novel strategy called BUY & HOLD. You may have heard of it. This is where you, as a consumer, invest in a company, not because you are looking to sell your shares after a few upticks, but because you want to continue to enjoy its products and participate in its long term growth. The BUY & HOLD approach has actually been known to work for a few venture capitalists – not to mention countless retail investors who have recognized solid appreciation simply by holding shares during even the most turbulent markets.

The debt side of P2P is a different animal altogether. Most online lenders are yield chasers. They don’t care whether their borrower is looking to pay for a wedding, refinance his credit card debt or purchase a flip house. They just want to be assured that they will get their interest and principal back within a reasonable timeframe. For them, liquidity is a more pressing need.

Fortunately, a growing number online lenders need not wait for the construction of a secondary marketplace to liquidate their P2P notes. There are some products in the Reg A+ debt universe that provide investors with immediate liquidity through issuer redemptions. And as the ingenuity in the Reg A+ debt space continues to proliferate, you can expect to see the emergence of some very innovative and liquid fixed income products in the near future. These new “money market alternatives” will satisfy the investor’s need for yield as well as his desire for liquidity.

NUMBER 8: UNLESS THE RULES CHANGE, SMALL CAP IPOS WILL REMAIN EASY TARGETS FOR STOCK MANIPULATION

The aftermarket for small cap IPOs continues to be dysfunctional and will remain defective absent regulatory intervention and a resurgence of investment demand for small cap stocks. These dynamics are creating a unique set of challenges specifically for Reg A+ IPOs.

First and foremost, the SEC’s alternative uptick rule (Rule 201) needs to be amended. Adopted in 2010, the well-intentioned rule was designed to restrict short sellers from further driving down the price of a stock that has dropped more than 10 percent in one day. Essentially, short selling is restricted when the price of a stock declines by 10 percent or more from the prior day’s closing price. However, the problem arises when a company makes its public debut. Because there is no “prior trading day” when a company goes public, the 10 percent circuit breaker is never triggered, thereby allowing IPOs to theoretically be shorted to zero. This loophole makes smaller lesser known IPOs – such as Reg A+ IPOs – a prime target for shorters and manipulators. Exacerbating the problem is that there is no over-allotment or greenshoe option for Reg A+ IPOs. The Greenshoe option is a special provision which allows underwriters to sell investors more shares than originally planned by the issuer. In doing so, it gives the underwriter the ability to stabilize the price of a new issue in the open market. Both of these shortcomings have proved debilitating for Reg A+ IPOs (for more color, watch this interview with Chicken Soup for the Soul Entertainment (NASDAQ: CSSE) CEO, Bill Rouhana Jr.)

Unless and until abusive shorting is curbed, manipulators will continue to wreak havoc on small IPOs, causing the demand for emerging growth companies to completely dry up. As the chart below underscores, publicly traded small caps have served as the backbone of the U.S. economy and the heart of global innovation for decades. The Reg A+ IPO could be our one chance to revive the small cap new issue market and reawaken economic growth before it disappears without a trace. In 2018, let’s endeavor to nip these abusive shorting practices in the bud so that we can re-inspire small cap investing. The SEC could start by simply amending the language in its alternative uptick rule so that the circuit breaker trigger for IPOs is not contingent on the prior day’s close.

NUMBER 7: TECH GIANTS LOVE ORGANIC KALE

In 2017, I discovered that technology behemoths love to devour organic kale. Of course I am referring to Amazon’s $13.7 billion acquisition of Whole Foods. I think that this is the most significant deal of the year and one that will have epic implications for FinTech. Did you know that nearly 50 cents out of every dollar spent online goes to Amazon? That little online book seller that went public 20 years ago, with losses of $5.78 million, is today worth nearly twice as much as Walmart. While Amazon’s growth is staggering, more impressive is its ability to attract and engage consumers. So what does this have to do with FinTech? Everything – for retail investors are merely consumers of financial products. I firmly believe that tomorrow’s FinTech success stories will be those companies that successfully tie consumption to investing. I’ll be writing a lot more about this in 2018. In the meantime, keep a lookout for Amazon’s future acquisition targets, for I believe they will provide an interesting indication of the direction of digital finance.

NUMBER 6: WE ARE NOT OFFICIALLY IN A BITCOIN BUBBLE UNTIL MY COUSIN CARA STARTS BUYING & THE AUTHORITIES START STEPPING IN

All I hear now is chatter about a Bitcoin bubble. It is so reminiscent of 2011 and 2012 when all everyone could talk about was the ostensible Facebook bubble. Back then, I denied the existence of a Facebook bubble. However, I started to see a little frothiness when my Cousin Cara – who never knew the difference between a stock and a sock – began asking me how she can get her hands on some Facebook shares. Once Cousin Cara enters a market, I know we’ve entered bubble territory. Fortunately, for those bullish on Bitcoin, at the present moment, my Cousin Cara can’t distinguish between a Bitcoin and a piece of Chocolate Chanukah Gelt. But once Cousin Cara starts asking me how she can get her hands on some Bitcoins, it is usually time to SELL, SELL SELL! There is, however, one exception to the Cousin Cara Rule: if there are millions upon millions of Cousin Caras clamoring for an asset, then there is no imminent bottom until the authorities step in and start bellowing, “irrational exuberance”. With the SEC beginning to suspend the trading of cryptocurrency-focused stocks, I think that the handwriting is on the wall and would tread cautiously. You also know we’re headed for a massive bubble burst when companies in the food and beverage or home improvement industries begin adding Bitcoin to their corporate names. Make sure to sell long before McDonald’s becomes BitDonald’s and Home Depot becomes Bitcoin Depot.

NUMBER 5: AN ICO IS AN INITIAL COIN OFFERING – NOT AN “INTRASTATE CROWDFINANCE OFFERING”

This one kind of stings. The bad news is I now need to rewrite chapter 8 of my Crowdfinance book. The good news is I haven’t published it yet. I guess there is always a silver lining.

NUMBER 4: THE CORPORATE WORLD IS LITTERED WITH UNSCRUPULOUS PEOPLE

Okay, I admit, this is something I actually learned a few years earlier. So, allow me to correct myself. 2017 taught me that the corporate world is besieged with some really, really, really, really unscrupulous people. There is no shortage of scoundrels and frauds who will lie, cheat, steal or even pimp out their mothers for a buck. What is most disconcerting is that because neither justice nor karma are instantaneous, these Machiavellians have ample time to deceive and harm others. Until justice is served or karma retaliates, the best we can do is stay on guard. Especially with cryptocurrency mania in high gear, be particularly leery of those claiming to be “ICO Connoisseurs” or the “King of Cryptocurrencies” as well as those representing to have relationships with financial institutions that possess over a trillion dollars in assets. Guess what – anyone with a $50 checking account at Citi has a relationship with an institution that holds more than a trillion dollars in assets.

NUMBER 3: FINANCE IS NOT THE MOST SEXIST INDUSTRY

Apparently there is less sexism on Wall Street than in Hollywood, Silicon Valley and in Broadcast Journalism. Even PBS has its share of monsters. And not all of them are blue, googly eyed and looking to gobble cookies. In 2017, the men in media made penny stock traders look like a bunch of choir boys. And don’t even get me started on the politicians. On what planet is it acceptable to use our taxpayer dollars to muzzle victims with settlement payouts? Which brings me to another lesson learned in 2017: don’t nap near Al Franken.

NUMBER 2: TIME IS THE ONLY TRUE COMMODITY AND CHANGE IS THE ONLY CONSTANT

Life is short. Business life expectancy is infinitely shorter. Today’s leaders are tomorrow’s lessons. Just ask Blockbuster, Excite and MySpace – trailblazers that have been outclassed by Netflix, Google and Facebook respectively. I think we will ultimately experience a similar transfer of leadership in FinTech. Take Bitcoin for example. Today, Bitcoin is a cryptocurrency Goliath. While its value appears to be headed into the stratosphere, at some point Bitcoin will head back to earth and possibly even crash and burn. But out of its ashes, a new cryptocurrency frontrunner will emerge. While its reign may end up to have been short lived, I believe that Bitcoin’s true legacy will be in having inspired the currency system of the future. But, who knows? The only sure bet is change. And the winners are those who are the best able to adapt and the quickest to act. There is no time to wait for tomorrow. Procrastination is the enemy of implementation. That is why, in business, we need to spend less time planning and more time executing. And likewise, in life, perhaps we need to dream a little less and live a little more.

NUMBER 1: ABBREVIATIONS CAN BE VERY COMPLEX

Believe it or not, the number one lesson I learned in 2017 is not a financial one or even a philosophical one. Rather, it is a grammatical one. This year, I learned that the correct abbreviation for “Associates” is “Assoc.” and not “Ass.” Go figure.

And, that’s a wrap. I’ll just conclude by wishing everyone – including all of my blessings, my lessons and, yes, even all of the “jack-assoc’s” of the world – a wonderful holiday season.

Great Article Dara. Keep it up!

Hey Dara,

For a minute I thought I was reading some long-lost Oscar Wilde!

If Crowdfunding is to be “The Democratization of The Capital Markets”

as we in the business like to imply, your cousin might just be our

next investor.