2016 will be etched in time as one of the most unpredictable and metamorphic years in our planet’s history. While every fragment of civilization will feel the effects of 2016, the year will leave an indelible imprint on financial services, global political landscapes and mass media for generations to come.

The year began with the renaissance of the retail investor and it ended with a massive crowdfinance conference which centered – for the first time – around the actual crowd (“retail”) investor.

The year began with the renaissance of the retail investor and it ended with a massive crowdfinance conference which centered – for the first time – around the actual crowd (“retail”) investor.

In between was the successful completion of the Elio Motors Reg A+ offering, the first phase of investment product ingenuity through JOBS Act exemptions, the launch of the first retail retirement technology, the “fix Crowdfunding bill”, the introduction of Congressman McHenry’s new FinTech legislation aimed at fostering financial innovation, the implementation of Reg CF, lots of industry turmoil, a surprising Brexit vote, and perhaps the most controversial and suspense-filled U.S. election in history.

2016 was also the year that the Cubs finally won another World Series and I discovered the video selfie.

Before I underscore how all of these events will have monumental economic implications on 2017 and beyond, let me just take a moment to boast about the accuracy of last year’s predictions.

Last December I forecasted that:

- Robo-advisors will find opportunities in crowdfinance – Just as I predicted, ETF-centric robo-advisors made an entrance into crowdfinance this year. In early 2016, robo adviser, Hedgeable, first entered the crowdfinance space by offering its retail clientele opportunities to venture invest through leading equity crowdfunding platforms such as AngelList and CircleUp. A few months later, Hedgeable announced that it will soon be rolling out a peer-to-peer lending product. Furthermore, based on conversations that I’ve had in recent months with robo-advisory firms as well as with companies that develop technology for robo-advisors, I anticipate many more robo-advisors will soon be joining the party.

- Retail Financial Product Ingenuity will Escalate – As discussed last year, GROUNDFLOOR made history in late 2015 with its Reg A+ qualification to offer micro-investors small pieces of real estate debt. In 2016, two more companies broke ground in the Reg A+ arena: StreetShares and American Homeowners Preservation – offering retail investors the ability to capture both monetary and social returns through micro-investments into private businesses as well as individual mortgages, respectively. Companies like these are helping to inspire a new generation of retail alternative products. This type of investment product ingenuity is about to spread well beyond online platforms and marketplaces. I predict that any financial services business involved in the production or sale of alternative securities will soon look to expand distribution by taking advantage of this modern regulatory framework.

- Straight Equity Title III Offerings will Fall Flat – Indeed they have. According to NextGen Crowdfunding, a leading provider of crowdfunding deal data, investors have committed to invest slightly more than $15 million into Title III equity crowdfunding campaigns during 2016. $15 million equates to approximately 60 Hillary Clinton speeches or the amount that the U.S. national debt grew since you started reading this article. $15 million won’t even begin to scratch the surface of fixing our economic woes. To put it bluntly, $15 million is not an industry – it’s barely even a house in the Hamptons! Unless and until more creative hybrid financing structures are employed for Reg CF offerings, the market for Title III Offerings will remain insignificant.

- Reg A+ “Testing The Waters” will Call Attention to Serious Title II Crowdfunding Flaws – While no one really cared much about this issue in 2016, I do believe that the considerable disparity between total “indications of interest” and the amount of funding actually raised will eventually lead to regulatory amendments. It is completely misleading for a company to “advertise” that it has garnered sizeable funding interest without ever having to notify the public that it failed to raise even a fraction of the amount.

- The Crowdfinance Playing Field will Undergo Leadership Change – Wow, was I right about this one! Industry leadership has begun to undergo significant change in 2016 – particularly in marketplace lending. I stand by my statement that, “New leaders will rise. Some unexpected frontrunners will fall. The businesses that will best be able to oblige the retail customer, adapt to regulatory changes, and penetrate retail’s $14+ trillion retirement capital will prevail.”

- Hoverboards will Disappear from Toy Store Shelves – Uh, I meant to say Galaxy Note 7’s will disappear from the shelves. Yeah, yeah, that’s the ticket. (In the era of “fake news” this totally passé catchphrase deserves to make a comeback).

While some of my last year’s prognostications have yet to fully reach fruition, I’m still standing by all of my 2016 predictions. I’ve come to realize that predictions, much like karma, operate on their own timetable. Even some of the prophecies of the great Nostradamus were a year or two off. And, let’s not forget that Robert Zemeckis was just one year too early in forecasting the Cubs World Series victory.

Speaking of which, you are probably wondering what the Cubbies winning the World Series and video-selfies have to do with the future of personal finance anyway.

A lot. Maybe even everything.

The Cubs World Series win and video selfies are empowering underdogs everywhere. If the most mocked team in the history of professional baseball can win a World Series and amateur videographers can become universally recognized broadcast journalists, then long shots everywhere can achieve astonishing victories. Non-politicians can win presidential elections. Non-lawyers can prevail in litigation. Small businesses can access capital as freely as large corporations. And primarily due to crucial advancements in micro-investing technology, even investing novices will be able to outperform financial experts. At long last, the little guy can have just as much of an opportunity to create wealth as the George Soros and Warren Buffet ilk.

This brings me to my bold 2017 predictions (or as Ron Suber would likely call them “Big Hairy Audacious” predictions).

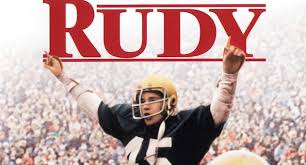

- Underdogs across the land will triumph in 2017 – The Chinese predict that 2017 will be the year of the rooster. I disagree. I believe that 2017 will be the year of the Rudy.

- The broader markets will correct – I foresee the broader markets headed for a crash – triggered primarily by manipulators, speculators and years of unsustainable monetary policy. Our public equity markets have been artificially propped up by policy for far too long. America simply can’t keep lowering rates and printing its way to prosperity. Interest rates have nowhere left to go but up, particularly if Trump makes good on his economic plan and we see some real economic growth. I foresee rate hikes leading to a stock market correction. Although it may be a short-lived correction, those who are well-diversified and have allocated some capital to less volatile, less correlated asset classes, will be better able to weather the storm.

- The face of financial media will Become Unrecognizable – In 2016 the established media awoke to the revelation that it no longer holds the relevancy that it did in previous generations – something housewives on Facebook have known since about 2008. Although it tried hard not to accept it, traditional media has been hemorrhaging influence for quite some time now. Just like how the video killed the radio star, how Napster crushed the CD, how Netflix annihilated Blockbuster and how Amazon overtook Barnes & Noble, communications technology is on an unstoppable path to demolish mainstream media. While bloggers have been gaining prominence for years at the expense of print media, it will be the video-selfie that delivers mainstream media its final blow. Financial media is no exception. The 2016 U.S. presidential election established social media – not television – as the dominant medium. Clearly, more people tuned into Infowars than to Rachel Maddow. If the video selfie can help influence a U.S. election, its impact on financial services will be colossal. Expect financial content to become edgier as well as more engaging, encompassing and interactive. Expect new financial voices to emerge and gain prominence. Most significantly, expect these new financial media players to forever transform the way people invest, where people invest and how people invest.

- FinTech will Expand into Older Demographics – I see countless FinTech business plans. Most of them are loaded with statistics on millennials, ideas for targeting millennials and even pictures of millennials. Yes, many of us industry folks are well-aware that millennials prefer having a root-canal than going to a bank. However, FinTech is not a millennial-centric market. I predict that 2017 will be the year that FinTech crosses demographical thresholds. I expect that older demographics will start incorporating FinTech into their daily routines. As a result, I envision more FinTech innovation being directed towards developing products for other generations, particularly retirees.

- The U.S. retirement infrastructure will begin to undergo monumental transformation in 2017 – The $14 trillion retail retirement industry is on the cusp of great transformation. Thanks to the progression of FinTech, RegTech and AltTech, the retirement industry is about to become fairer, simpler and more inclusive. Expect regulatory and technological innovations to be introduced that will unwind a broken and unjust retirement system. Expect retirement plans to become more consumption driven than employment-based. You can also look forward to seeing the mass adoption of game-changing financial products that will give everyone – including present retirees – a fighting chance to prosper throughout their senior years.

The story of financial services is unfolding and it is growing more fascinating by the minute. And I am truly grateful to be alive at this particular moment in time to witness it firsthand.

Anyone who has read my previous year-end articles knows how reflective I tend to get as I approach my Christmas Eve birthday. And this year I am especially pensive given the fact that I am turning 29 (again) and that mercury is in retrograde and that Uranus (pronounced: “Your Ron Issss”) is, well it is somewhere in the universe doing something to affect my mood. Whenever that happens, I tend to seek inspiration in a poem, a lyric or even in just one simple word.

It is for this very reason that I subscribe to dictionary.com’s word of the day. On December 16th, dictionary.com’s word of the day was “hotsy-totsy” and it means, “about as right as can be”. Because I vowed to find a way to incorporate this quirky “makes-you-feel-like-skipping” word into an article, I would like to simply conclude by wishing everyone a joyous holiday season and a very hotsy-totsy 2017!

If anyone can spare the time I would be very grateful if you could give me your opinion of at least the basic premise of the following proposed EQUITY CrowdFunding website/platform, if not it’s various related aspects–I honestly believe that, among other things(itemized on my website), If EQUITY CrowdFunding is ever going to reach it’s maximum potential, that it will take a website/platform on the order of the one proposed below. Thank you very much.

.

.

.

A NEW KIND OF EQUITY CROWDFUNDING WEBSITE/PLATFORM:

.

I have always believed that the solution to the vast majority of the problems facing all sectors of our society exist in the hearts, minds & imaginations of millions of people in all walks of life, the world over. So it is no surprise that from the very first time that I learned of Crowd Funding a few years ago I said to myself(and posted it on several ‘discussion’ websites)that when all of the ‘kinks’ have been worked out of the EQUITY sector of it, that it would eventually become the biggest form of business expansion & ‘start up’ capital in the history of the world!!!

After much thought and contemplation I realize that it will take a lot of innovative, old fashioned, ‘out-of-the-box’ type of thinking, using all the many benefits of, and lessons learned, from ‘Crowd Sourcing’, to work out all of the multiple intricate details that will be required to create the kind of a CF ‘platform’ which will be able to even come close to successfully fulfilling this promise. If the legal aspects related to it can be properly settled, and although there are many other things that must be successfully overcome in order for this ‘platform’ to become a reality, there is no reason why they can’t be, as there is nothing of an impossible nature involved in doing so, as there is no need for any kind of knowledge or technology that doesn’t already exist.

.

The premise for the kind of CF website/platform that it would take to fulfill this promise came to me while I was reading about the proliferation of various global ‘crowd sourced’ type programs of all kinds which used the WILLING help & ideas of tens of thousands of people(who weren’t getting paid anything)to solve problems or create ‘solutions’ to a vast array of ‘projects’ in all sectors of society—the one I am suggesting would be one based on this same principle but where those who participated in the ‘crowd sourcing’ of a project could also be ‘co-founders’/’partners’ in it as well!!

.

It makes logical sense that if people are willing to spend their time, effort & knowledge ‘crowd sourcing’ projects that won’t benefit them in any material way, what would they be willing to do if they had the chance to ‘crowd source’ an idea that they liked(either theirs or someone else’s)which they could also be ‘co-founders’/’partners’ in, right from the ‘idea’ stage right on through to it’s implementation into the ‘marketplace’ and then right on to its continuing operation on a day to day basis, WITH THE VAST MAJORITY OF IT BEING DONE VIA THE INTERNET!!!

.

In order for this kind of a website to ever have a chance to become reality it will first be necessary to find out with regard to ‘start up’ ventures in general, just how the major global SEC type governing bodies define/differentiate between simply being ‘investors’ in them as opposed to being actual ‘partners’/’co-founders’ in them—in other words, it will be necessary to find a way that, at least in the beginning, will possibly let tens of thousands of people become ‘partners’/’co-founders’ in a ‘start up’ venture without conflicting with &/or being subjected to any SEC rules/regulations as they relate to simply being investors in them.

The three main reasons, of many, why ‘Equity Crowd Funding’ has the realistic potential to become the biggest form of business expansion & ‘start up’ capital in the history of the world, are the following:

.

1)there are vast regions of the world where there aren’t many, if any, ‘organized’ VC/’angel’ or other type venues of this nature that even fund ‘startups’.

2)Having to be under the jurisdiction of SEC type entities and subject to their rules & regulations results in the amount of money that it takes just to initiate a reputable equity CF campaign costing a few thousand dollars to cover the costs of various fees, permits and other type initial payments that need to be paid to applicable agencies as well as to the CF platform itself—this amount is too much for most ‘start ups’ to pay, and which will in combination with several other factors, result in vast numbers of potentially successful ‘start ups’ to never even get the chance to be seen by anyone, much less ever getting the chance to be considered for any type of actual funding.

3)funding for ‘startups’, even in the best locations and under the best of circumstances, isn’t that easy to acquire—consider the following fact: each year a lot less less than 1 in a thousand proposed ‘start up’ business ventures that would like to be funded are ever even looked at &/or considered for ‘outside’ funding, and for every thousand that do get looked at, only 6 or 7 of those are ever funded, and finally out of every thousand ‘start ups’ that eventually get funded, only about 100 of them end up being what is considered ‘SUCCESSFUL’!!!

4)because of the internet’s vast global reach, this CF ‘platform’ will be be able to address the ‘start up’ funding needs of a ‘global’ audience, so that every single person in the world who has any kind of a legal money making venture/proposition which they would like to find funding for, will have easy access to a way to do so.

5)because the original ‘founder’ of a proposed ‘start up’ will be seeking ‘partners’/’co-founders’ for their ‘start up’ as opposed to simply looking for ‘contributors’ to it or for ‘investors in it, they won’t have the need for as an extensive ‘social media’ following that most CF ‘platforms’ say is necessary in order to have a reasonable chance for any type of CF campaign to become successful–which, of course, requires a lot of time and effort to ‘assemble’ one properly.

.

Globally, there are millions of first time ‘wannabe’entrepreneurs who are seeking funding for their own particular product/service/technology business’s(or even for just some other type of legal potential money making venture in virtually any sector of society, or possibly even just an idea for something that will save or make a given entity a lot of money)which they feel to the very depths of their of their hearts,

minds, bodies AND ‘souls’ may indeed be, if not ‘THE NEXT BIG THING’, at least a very successful business enterprise. Unfortunately however, most of these neophyte entrepreneurs, like me, for any number of legitimate reasons, simply don’t have many(if any at all) of the mandatory skills/qualities that a ‘conventional’ entrepreneur needs to have in order to have a reasonable chance to become successful, nor do they have much, if any, experience in either starting or running a business enterprise(or, for that matter, even creating/managing a ‘quality’ CF campaign).

.

In the end, the only thing that all of these neophyte entrepreneurs want is simply the opportunity to be able to show the world just what it is that they’ve got, and hopefully find others out there who share their vision/passion for it, and who, in exchange for them providing some of the money/expertise/’sweat equity’ that will be necessary to help in getting it out there into the ‘marketplace’, will relinquishing a certain amount of equity/control in the venture by making them ‘partners’/’co-founders’ in it.

.

Most founders of a ‘start up’ are very reluctant to relinquish much equity &/or control in their particular venture even to acquire the funding that they must have in order to give it a fair chance at success. HOWEVER, IF THEY CAN BE MADE TO DEFINITIVELY UNDERSTAND THE SIGNIFICANCE OF THE ABOVE FACTS/STATISTICS and their potential repercussions with regard to how few proposed ‘start ups’ actually ever get funded, it should DEFINITIVELY PROVE TO THEM THAT having to give up some of both equity and control in their ‘start up’ is their only realistic chance to see it ever become reality, and that this CF platform is their best chance of attaining that success.

.

It doesn’t take a ‘rocket scientist’ to understand the various implications of just what these above facts/ figures/statistics means when it comes to the various ‘obstacles’ that these ‘neophyte’ entrepreneurs will have to face in order to have any reasonable chance to be successful with their ‘start up’ ventures-in other words, how can they be expected on their own to be very successful with their ‘start up’ venture when they have no money, expertise or experience in the business sector—when the above statistics show very clearly that every year even the very best ventures picked by the very best ‘experts’ and headed by fully qualified ‘teams’ that are backed by millions of dollars of investment capital can’t even be successful more than 10% of the time??

.

The following 4 ‘sectors’ are among the most important of many that must be successfully addressed in order for this CF ‘platform’ to have any chance of working properly:

1)a key to the success of this type of CF website/platform will be coming up with a ‘foolproof’ type of voting system whereby all internal factors not covered by permanently stated rules/regulations and other SOP’s will be decided by a majority vote of the ‘co-founders’ themselves(from the pay of the ‘physical’ management team to how much a persons disputed ‘sweat equity’ is worth in company shares, as well as ‘firing’ any ‘partners’ who cause problems and how much to compensate them for the work that they have already done, etc.).

.

2)Many of the ventures that will be posted on this website, if they are successful in their funding campaign, will eventually need several people to have an actual ‘physical’ presence out there in the ‘real world’, who will be responsible for all of the ‘physical’ duties related to the ‘day to day operation/management’ of the venture which can’t be done via the internet(it may be necessary for these people to re-locate, depending on the nature of the venture)—all of the ‘partners’ in this venture are eligible to put in their ‘resume’ for any of the open ‘physical’ positions, which will be selected by a vote of all of the ‘partners’ in the venture(who will also decide, among other things, the number of people necessary to be on this ‘physical team’, as well as their yearly compensation).

.

3)The amount of ‘equity’ the ‘owner’ is willing to relinquish to any ‘partners’/’co-founders’ that want to be a part of his venture(assuming that, at the end of the ‘campaign’, the necessary amount of money has been raised to continue with it), each ‘partner’/’co-founder’s share of equity will be determined by both the amount of money that they ‘invested’ in it—relative to the total amount invested in it—as well as the dollar amount of ‘sweat equity’ type of work that they have contributed to it, a figure which, like several other aspects of this ‘platform’, will be determined by a yet to be created ‘algorithm’ type of ‘formula’.

.

4)All aspects of this ‘platform’ must be set up to run like a ‘well oiled machine’ that will accommodate thousands of people working together for the common purpose of successfully creating the proposed business enterprise that they are all ‘co-founders’/’partners’ in.

..

I believe that if you have hundreds/thousands of people who believe in a ‘start up’ venture enough to voluntarily put up their own time, effort & money to see it become a success, and you have a working platform that is conducive to allowing all aspects of the creation of the ‘start up’ to proceed smoothly, you can be sure that if there is as big a market out there for their product &/or service as all the ‘partners’ in the venture obviously believe that there is, they will all be trying their absolute best to try and make it a success—and somewhere among them, there will be several of them that are proficient enough in all of the necessary ‘skill sets’ required to get the job done right.

.

So in closing, let me just say that despite the many daunting ‘challenges’ that need to be overcome in order to make this ‘start up’ venture a success, the many potential positive results of something like this becoming a success will have many far reaching positive implications/ramifications in all areas of both the ‘start up’ sector of business, as well as in many other sectors as well, and will make all of the time, effort and money expended to attain that success–and enduring all of the ‘naysayers’ comments on how it can never be done–well worth the ‘fight’!!!

.

P.S.This type of ‘Crowd Funding’ platform’ could also be used to connect like minded people in a given ‘metropolitan’ area who would like to go into business for themselves but need like minded local ‘partners’ for the necessary money &/or for skills/expertise that they lack in order to be able accomplish it(see a more detailed description of this proposed CF website at the link below).

.

Discount Convenience Stores (http://discounstores.weebly.com